Cash Management with Iron Age Investments

Unlock the potential of your investments with a strategic approach that balances risk and reward.

Understanding Laddering

The Power of Laddered Investments

Laddering is a sophisticated investment strategy that involves dividing your capital into several fixed-income notes with varying maturity dates. This approach ensures that your funds are not tied up in a single term, allowing your investments to mature at different times. The benefits include a consistent cash flow as each note reaches maturity, the ability to reinvest at potentially higher rates, and the opportunity to leverage compounding interest to enhance your financial growth.

Key Benefits of Laddering

Steady Cash Flow

Enjoy regular income as each note matures, providing a reliable stream of cash.

Investment Flexibility

Reinvest at new rates as market conditions change, optimizing your returns.

Compounding Growth

Accelerate wealth accumulation by reinvesting interest payments into future notes.

Why Consider Laddering Notes?

Maximize Your Investment Returns

Investors seeking to optimize their returns should consider laddering notes due to its strategic advantages. By spreading investments across notes with staggered maturities, investors can achieve higher yields, often targeting returns around 10% annually. This approach surpasses the minimal gains from traditional savings accounts or money market funds. Additionally, laddering allows for compounding growth, where reinvested interest payments accelerate wealth accumulation over time. The strategy also offers liquidity, as portions of the investment mature regularly, providing flexibility to reinvest at potentially higher rates.

Moreover, laddering notes with Iron Age Investments ensures that your funds are actively working at different intervals, creating a steady cash flow. This method not only enhances the potential for higher returns but also mitigates risks associated with locking all funds into a single maturity term. Investors can enjoy the benefits of a diversified portfolio without the volatility typically associated with stock markets.

Key Takeaways for Investors

Laddered notes with Iron Age Investments offer higher yields than traditional savings, while reinvested interest accelerates compounding and wealth growth. Staggered maturities ensure steady liquidity, giving investors regular access to cash for reinvestment or new opportunities. This strategy balances stability, flexibility, and growth—making your money work harder while avoiding market volatility.

-

Higher Yields: Outperform conventional savings and CDs.

-

Compounding Effect: Reinvested interest drives faster wealth accumulation.

-

Liquidity: Regular access to maturing notes provides flexibility.

-

Reduced Risk: Avoids full exposure to market swings.

-

Ideal For: Investors seeking predictable income + growth potential.

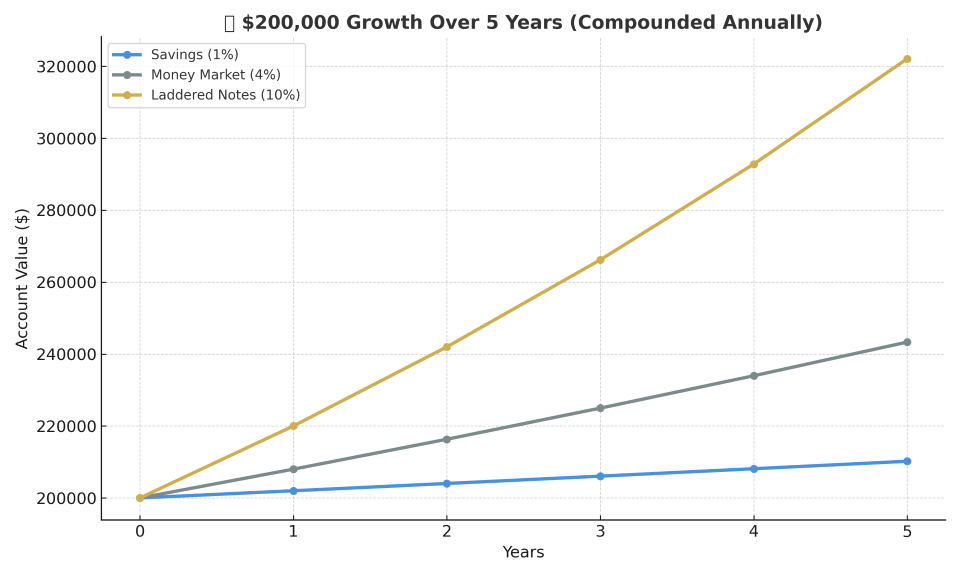

Investment Growth Comparison

Initial Investment

Investment Growth Comparison

Investment Type

Savings Account

Money Market Fund

Laddered Notes

Year 1 Growth

$202,000

$208,000

$220,000

Year 3 Growth

$206,060

$216,320

$266,200

Year 5 Growth

$210,201

$243,330

$322,102

Total Growth

5%

21.7%

61.1%

Annual Yield

1%

4%

10%

Liquidity

High

High

3-6 mo’s